Join over 2,000 brand and agency leaders who rely on the Mojito Mixer to stay ahead with in-depth Web3 insights, comprehensive analysis, and updates on top brands making strides into Web3

.png)

Wallets-as-a-Service & Web2.5

Mojito explainer on wallets-as-a-service, offerings in the space, and benefits for brands and consumers.

Recently, wallets-as-a-service startup Magic raised $52mm from PayPal and others. This post breaks down what 'wallets-as-a-service' means, introduces similar solutions in Paper, Crossmint, Sequence, and Coinbase, and how brand and agency leaders should think about this within their broader consumer engagement strategy.

'Wallets-as-a-service' is not about hardware wallets like Ledger for self-sovereign diehards, or self-hosted web wallets like MetaMask that require safely storing a seed phrase offline and paying your own gas. It's not for web3 natives, in other words. It's for onboarding the mainstream!

'Wallets-as-a-service' are one of several emerging technologies that make up the growing 'web2.5' trend in general, which is about making selective decentralization trade-offs in pursuit of a seamless user experience that still delivers on digital ownership and interoperability.

.png)

How 'wallets-as-a-service' work, and how brands and consumers benefit

If you've ever tried to set up a web3 wallet, you know how much friction is involved.

Instead of a simple email-password, you are given a 'seed phrase' of random words that you need to write down and store offline for maximum safekeeping. This is how web3 maintains full decentralization: no one but you is capable of gaining access to your account or acting on your behalf. This is great for certain use cases when users are ready to climb the learning curve, but for onboarding new consumers to the space with sometimes free-to-earn digital assets, it's just overkill.

Of course, the opposite of a fully decentralized wallet is a fully custodial wallet: one in which the brand owns, controls, and is liable for the users' wallets and their contents. This approach may be right for some brands (though we at Mojito often question it), but for others looking for a middle ground: 'wallets-as-a-service' was born.

.png)

Wallets-as-a-service use an underlying technology called multi-party computation.

Instead of asking consumers to store their own private key with a seed phrase offline, the private key is 'sharded' into three fragments of data, two of which are needed in order to control the wallet. Each is encrypted and authenticated uniquely:

1. Email/SMS -- One fragment is tied to the consumer's email or phone number, and requires proof of ownership through a one-time password like 2FA.

2. Local Device ID -- Another fragment is tied to the consumer's physical device or browser that was used to create the wallet.

3. Vendor Solution -- The third fragment is stored by the wallet-as-a-service provider with a range of security options, some better than others.

The consumer can operate the wallet with two of the three shards, while the wallet-as-a-service company can never unilaterally gain control.

THIS IS ALL IN THE BACKGROUND.

The consumer is never aware or bothered by any of this. This makes for a seamless wallet experience where users don't pay gas, and brands don't take on unnecessary risk or liability because the wallet is also non-custodial.

.png)

Our 0.02 ETH 🍃

Mojito has met with all of these teams, tried all of their tech, and used multiple in the wild with customers.

- Magic -- The most well-funded, largest headcount, and longest tenured team, however, also the priciest and most centralized in terms of security.

- Paper -- The fastest, most secure, and most white-labeled product we tested on the market with the most flexible team and approach to partnerships.

- Crossmint -- The most b2b2c focused in terms of creating a direct-to-consumer connection with their own brand and family of growing apps.

- Sequence -- The most gaming focused, and farthest ahead on smart contract wallets (ERC-4337).

- Coinbase -- Mobile-only 'wallet-as-a-service' right now, but already has one of the best self-hosted wallets with their exchange and on/off-ramps plugged in.

.png)

.png)

At Mojito, we believe the future of consumer engagement is onchain.

This is important for you to know -- brand and agency leaders -- but consumers should not need to know or understand this any more than 'omnichannel'. That's what web2.5 is all about, and wallets-as-a-service are a helpful piece of that puzzle (dynamic NFTs, too!), which will continue to evolve.

The key thing to solve for isn't your wallet provider. They're largely at parity and easily interchangeable / upgradeable. The key thing is your holistic product offering, which isn't influenced or constrained by your 'wallet-as-a-service' provider, but instead unlocked by use-case solutions like Mojito, which has wallet-as-a-service built right in.

Mojito enables brands to launch end-to-end web3 consumer engagement campaigns including wallets-as-a-service, fiat and crypto payments, free mint and paid drop mechanics, white-label secondary marketplaces, token-gating, and onchain rewards.

With Mojito, you can tailor your brand experiences for mainstream users only, web3-natives only, or both.

As always, we love talking web3 consumer engagement with brand and agency leaders. Whether you're sourcing tech solutions with a clear scope, timeline and budget in mind, or you're just getting started, Mojito can help you every step of the way. Share your contact details and our team will reach out for an exploratory chat. Get in touch.

Sign up for news, trends and analysis on tap. Join 2,300+ brand leaders going deeper into web3

Dynamic NFTs: The future of consumer engagement is onchain

Mojito explainer on Dynamic NFTs, brand use cases, and benefits for brands.

NFT ‘metadata’ has mostly consisted of JPGs, GIFs, and MP4s, and the more advanced collections have traits and rarity. Critically, creators haven't changed the metadata, in some cases they even ‘froze’ it to prevent tampering or ‘rugs’ post-mint.

But innovative brand and agency leaders are poking holes in this dogma, and starting to realize what is possible with ‘dynamic metadata’ – updating a consumer's NFT metadata over time. It’s not just about possible new artforms or content, it’s about the fundamentals of how brands and agencies leverage consumer data itself.

“NFTs: your ticket into a brand’s action," wrote MediaMonks Web3 Director Michael Litman.

"We’re entering an ownership era where everyone has a chance to own a piece of the action. This ownership partly lies in NFTs or digital collectibles, which can be many things—an artwork that evolves over time as users get involved, a digital object, and more.”

How will brands and agencies personalize experiences and tailor ads in a future without cookies? How will developers create unified consumer experiences across disparate brand properties or different brands altogether? How can consumers achieve a more elevated digital experience without compromising on privacy?

Dynamic NFTs may be part of the solution. It’s not a consumer-facing term by any means, but it may soon become a key piece of every brand and agency's consumer data and engagement strategy. Here’s an explainer, today’s most helpful use cases, and where we see Dynamic NFTs going at Mojito.

What are Dynamic NFTs?

First it’s worth clarifying: What is an NFT?

An NFT is an unique digital asset owned by a single individual or entity at any given time. This digital asset maintains its own records, too: NFT 'metadata' can reference a near-unlimited amount of content, code, and raw data. When consumers 'connect wallet' to websites or apps, the brand can 'see' what assets they own and 'read' the metadata.

Traditionally, creators ‘froze’ or otherwise swore to never change their NFT metadata after minting. Imagine buying a physical product off the shelf, and by the time you brought it home, the manufacturer had somehow altered it completely, or even somehow ‘deleted’ it. This is why best practice was to never change the metadata: otherwise, consumers couldn't trust its lasting value.

But then some people got creative, and wanted to play with the idea of dynamic onchain art where the work changes over time, and not only that, but changes based on signals it receives from the internet (!!). One of the earliest and most famous examples of this is the Bitcoin Volatility Art by Matt Kane that changes daily based on the past 24 hours of Bitcoin trading activity.

.webp)

Our 0.02 ETH 🍃

- Bitcoin Volatility Art dynamically updates its metadata based on recent market trends, but there's no reason it couldn't be driven by anything else. What offchain sources of engagement data would you wish to capture, reflect or incentivize onchain?

- Brands and agencies don't necessarily need to do anything other than 'update' the NFT metadata with these touchpoints, and possibly maintain an omnichannel 'consumer profile score'.

- This would then be 'readable' by any website or app to enable personalized experiences on first-party and third-party platforms. These insights have gotten people in our industry thinking….

LaMelo Ball (NBA) - Dynamic Content

In 2021, NBA star LaMelo Ball sold 10,000 digital collectibles in partnership with Chainlink, a company that specializes in bridging offchain and onchain data, with the premise that if Ball should win the Rookie of the Year award later that season, the collectibles would 'evolve in a more powerful version'. This means dynamically updating its visual appearance as well as its 'rarity', an important aspect of collectibles markets.

Our 0.02 ETH 🍃

- Imagine fantasy sports, reality TV, or other 'live data' enhancements driving desirable outcomes in a consumer's chosen collectibles, say, during a prediction or even betting contest. What would be right for you?

Australian Open (tennis) - Dynamic Content & Rewards

In 2022, the Australian Open sold 6,776 digital collectibles called AO ArtBalls in partnership with Hawk-Eye, a company that linked each NFT to a specific area on the court and triggered dynamic updates to corresponding NFT for each match point.

AO Artball 'lucky winners' each earned 'upgraded' NFT artwork, but also free redeemable tickets to the next tournament.

Our 0.02 ETH 🍃

- Upgrade the artwork when relevant, sure, but add loyalty points or access to free redeemables dynamically within the same NFT metadata, and the reward is suddenly that much more real and valuable.

gmoney & 9dcc (fashion) - Dynamic Rewards & Community

Crypto-native lifestyle brand 9dcc incentivizes weekend wear amongst its ambassadors through flash mini-games that generate loyalty points and is only playable if you have the NFC-chipped garment nearby (or preferably, on your person).

Founder and CEO gmoney designed these 'network points' to be a dynamic element within the 9dcc ecosystem, stored offchain but tied to each consumer's onchain identity.

"How do you find and incentivize those fervent brand people to become bigger ambassadors? That’s what I’m trying to mess around with." @gmoney

Our 0.02 ETH 🍃

- The future of consumer engagement is onchain. But that doesn't mean that literally all the data is onchain, public, transparent and immutable. Here we see gmoney decide to store his network points offchain for privacy but with an onchain reference (i.e. wallet, NFT pass) to leverage within his own platforms or others where he shares permission.

- This is indicative of a broader trend within web3 called web2.5 (coined by yours truly!). Rather than decentralizing everything, this term refers to applications that blend centralized and decentralized tech in order to achieve a necessary balance between desirable web3 features, a smooth and familiar user experience, and corporate risk management. This is our specialty at Mojito!

What are the brand benefits for Dynamic NFTs today?

You can’t sell consumers a better database. You need to sell applications and benefits instead. So what can brands and agencies offer with Dynamic NFTs today?

- Onchain Loyalty Points – Distribute fan or membership passes, then increment/decrement their loyalty points ‘in the metadata’ every time they interact with your brand or redeem rewards. Omnichannel, omniplatform, cross-brand. No fungible tokens necessary. Lightest possible legal and operational lift for web3 rewards program.

- Personalized Token-Gating – Deliver richer experiences and tailored rewards informed not just by token ownership alone, but all relevant engagement data including social, ecommerce, and IRL. Gate websites, apps, games, and events. Generate and distribute additional points at the point of ‘check-in’ for surprise and delight.

- Memberships/Subscriptions – Sell time-access passes with expiration dates in the metadata. Consumers may keep their passes after expiration for limited access to certain community spaces or re-entry discounts, but to retain access to members-only spaces, they would need to pay a subscription fee or simply ‘buy more time’ on their expiration date. Token-gates would read not just the presence of the pass but the expiration date within its metadata to determine whether to let the user through.

- Physical x Digital Enhancements – Pair NFC-enabled spaces, objects, and garments with digital rewards schemes to drive IRL engagement and a bridge from geo-constrained, time-limited physical experiences to boundless, timeless digital ecosystems. Making a bit of a comeback, the humble NFC chip delivers a more delightful user experience than QR codes, and is much more technically capable, too, meaning many clever ways to ‘read’ and ‘update’ a user’s NFT metadata through ‘proof of proximity’ engagement campaigns

"Web3 wallets are the new cookies but the difference is that, this time, it belongs to the customer," said Salesforce SVP Marc Mathieu.

"The big difference is that these people are no longer just consumers, they want to be co-creators co-innovators, collaborators, and co-beneficiaries.”

Here's how to get started with Dynamic NFTs for your brand:

- Identify 2-5 key engagements you want to track and reward digitally.

- Define 1-2 valuable rewards and thresholds for engagement.

- Contact Mojito to get it all done, on budget and on time.

As always, we love talking web3 consumer engagement with brand and agency leaders. Whether you're sourcing tech solutions with a clear scope, timeline and budget in mind, or you're just getting started, Mojito can help you every step of the way. Share your contact details and our team will reach out for an exploratory chat. Get in touch.

Sign up for news, trends and analysis on tap. Join 2,300+ brand leaders going deeper into web3

Recap | What are Redeemables, great brand examples and build considerations

Mojito explainer on Redeemable NFTs, best use cases & build considerations for brands.

Image credit: RTFKT x Nike Cryptokicks

Here’s an explainer on Redeemable NFTs, today’s most helpful use cases and build considerations based on a number of active projects and exciting conversations with brand leaders at Mojito.

What are Redeemables?

Redeemable NFTs are a digital token that can be exchanged for a physical good or service in the future (e.g. physical items, pre-sales, tickets, merch, physical artwork, special offers, access). Along with RWAs (real-world assets) and asset-backed NFTs, these terms are all used interchangeably, so for the purposes of this explainer, we’ll call them Redeemables.

Redeemables are gaining significant traction as a way for brands to seamlessly tie together physical goods and digital twins, giving the brand enhanced engagement/loyalty opportunities as well as net new revenue streams.

What are the brand benefits of offering Redeemables?

- 🛍️ Offers consumers tangible value | This makes a digital NFT more attractive to potential primary and secondary buyers because they can at least peg the value of the NFT to something tangible in the real world.

- 🖼️ Better liquidity and optionality for consumers | Especially for traditionally illiquid and siloed markets like art, handbags, sneakers, watches, or wine & spirits, NFTs offer brands and buyers more transparency and optionality when buying and reselling.

- 💹 Secondary market revenue for brands | Every time the Redeemable NFT (which represents the physical good or service onchain) trades hands, the brand can receive a piece of that sale through a royalty enforced on-platform and possibly beyond.

- 💰New revenue streams for brands | Tap royalties from the secondary market. Generate incremental revenue from preorder trading. Incentivize stockpiling with future rewards and benefits.

- 🧐 Authentication to ensure a premium product experience on the secondary market | Redeemables can also offer authentication assurances to ensure an excellent Brand experience in the primary and secondary. Examples include a Certificate of Authenticity (e.g. Nike Air Force 1s or Ticketmaster tickets), or storage assurance (e.g. temperature, packaging, light for Wine) or insurance certificates (luxury products).

- 👀 Open-source visibility of redemption events | When a redemption occurs onchain, one NFT is submitted to the brand and another NFT from a 'redeemed' collection' is received in its place. This method enables distinct clarity between Redeemed and Unredeemed NFTs onchain while retaining the ability to market to users based upon onchain data and assets.

What are some notable use cases?

Retail

Nike’s Cryptokicks are digital collectibles that can be redeemed for their physical counterpart sneakers in a process RTFKT calls ‘Forging.’ During Nike x RTFKT’s Forging events, "holders of eligible digital collectibles can redeem for limited made-to-order physical products. Forging events last for a limited time, so always check for dates and set reminders."

Premium fashion

Cristóbal Balenciaga’s ‘To the Moon’ drop came with redeemables such as Balenciaga gear, gift cards to designer Brands and even the 70-year-old drawings by Cristóbal.

Sport

Every Australian Open tennis AO ArtBall NFT was redeemable for 2 tickets to the Australian Open tennis grand-slam in 2023.

Premium beverages

Glenfiddich single malt Scotch whisky launched 200 limited-edition ‘Chinese Lunar New Year NFTs’. Each NFT is linked to a physical bottle of Glenfiddich 21 Year Old Gran Reserva single malt and serves as a digital receipt verifying ownership and authenticity. NFT collectors can hold it, resell on an NFT marketplace, or redeem it for the physical bottle.

Considerations for creating Redeemables

What happens to the NFT when someone redeems the real-world asset? In short, it depends on how the brand builds it.

A number of options are possible with differing pros and cons, with one winning approach emerging.

1. 🔥 ‘Burn it’

The NFT is burned when the consumer redeems the physical good or experience. The NFT is no longer functional or ‘owned’ by anyone.

Pros: simplest to execute. campaign is over.

Cons: ‘Burning NFTs’ removes people from your token-holding community, which brands very typically shouldn't want to do.

2. 🛍️ ‘Trade it in’

Consumer sends the NFT to the brand’s treasury wallet, and once received, the brand ships them the physical item. The NFT is now owned by the brand.

Pros: the brand owns the NFT supply and could choose to resell to other holders at a later date.

Cons: the brand loses a valuable customer, the consumer is no-longer invested in the success of the NFT project, only enjoying the lifetime value of the physical item. It signals that the brand sees more value from owning it than the customer does.

3. 📭 'Stamp it’

When the consumer redeems the physical good, the NFT metadata is updated to distinguish [REDEEMED] v [UNREDEEMED].

Pros: Consumers are still invested in the success of the NFT project. Maintaining ongoing onchain continuity is a priority for both the brand and holders.

Brands get access to a secondary market, authentication assurances, new revenue streams and opportunities to create imaginative loyalty tiers that build LTV.

Consumers get to choose whether they claim the physical item. Secondary buyers get access to a liquid open marketplace with assurances the NFT will come with the right to claim the physical item.

Cons: Depending on the secondary marketplace experience, consumers may not be able to decipher between the REDEEMED and UNREDEEMED markets and offerings with this technical method, which can result in buyer regret and negative sentiment from purchases of NFTs where the physical item was already redeemed. This is easily managed by issuing a second token. How? Read on:

Serving up a ‘Stamp it’ example from tennis

To crystallize the ‘Stamp it' concept, we’ll unpack a live brand case study where physical items were linked to the NFT, in this example as ‘tickets’ to a live event.

For any brand leader in another vertical, the ‘tickets’ could easily be interchanged with any physical POS item like premium handbags, sneakers etc.

NFT Collection 1

The tennis grand slam event Australian Open launched an NFT project with 6776 NFTs in Collection 1 uniquely numbered #0001 - #6776. The artwork from Collection 1 are tennis balls wrapped with art hence AO ArtBall.

The Redeemables

Every Australian Open NFT from Collection 1 gets to claim 2 tickets to the Australian Open 2023 finals week starting 20th January 2023, for free, redeemed via a simple token-gated experience.

NFT Metadata on Collection 1 was updated

When consumers redeemed their tickets, the NFT metadata was updated to show REDEEMED. The metadata makes up the NFT and is traceable on the blockchain.

Additional NFTs from Collection 2 are issued to holders

At the same time, for consumers who redeemed the tickets, the Australian Open issued them a new NFT from Collection 2 [CLAIMED], directly to their wallet. Collection 2 NFTsfor example could have different artwork, a Certificate of Authenticity (COA) that provides extra validation that the Ticketmaster tickets are genuine.

Why? This is two-fold

- The Brand, Australian Open can isolate which NFTs are associated with [CLAIMED] tickets, distribute tickets to holders via Ticketmaster, track trading data, the floor price of Collection 1 [UNCLAIMED] vs Collection 2 [CLAIMED], reward this new tier of engaged customer i.e. the first claimers of Redeemable tickets, proof of attendance etc; and

- Potential secondary NFT buyers on the secondary market can see which NFTs have tickets [UNCLAIMED] from collection 1, make a bid with confidence they have the right to receive the 2 tickets. The COA can travel with the tickets.

Pre-order visibility

Australian Open can forecast token holder attendance at the stadium gates and revenue holders may spend in the precinct; and has enriched data as to which NFT holders are most likely to attend their live experience.

Our 0.02 ETH 🍃

We recommend Brands considering adding Redeemables to their loyalty stack issue a second NFT when the physical item is claimed so potential customers can easily distinguish between which NFTs on the secondary have had their physical item claimed. Brands get to track trading data between claimed and unclaimed redeemables and reward a new tier of engaged customers to grow LTV.

The future of Redeemables with Mojito

We’re weeks away from launching a live example of Redeemables, we can’t wait to share with you. If you’re interested in building Redeemables into your loyalty stack? Get in touch

Signup for news, trends and analysis on tap. Join 2,000+ brand leaders going deeper into web3

TIME Pieces by Time Magazine the first tokenized subscription from a major media brand

Mojito spotlights TIME Magazine, the first major media brand to launch a tokenized subscription offering.

Image credit: TIME

First major media brand to pioneer token as a digital subscription

TIME was the first media giant to experiment with web3 and has a number of marquee initiatives. TIMEPieces genesis collection, themed “Building a Better Future,” featured original artwork from more than 40 influential artists. Owning a TIMEPiece will also unlock unlimited access to TIME.com through TIME’s 100th anniversary in 2023, exclusive invites to TIME’s in-person events, and access to special digital experiences. Owners of multiple pieces will also be extended additional opportunities. TIME was the first media brand to add Connect Wallet, validate TIMEPiece NFT ownership and serve the TIME subscription content seamlessly along with a membership rewards program.

The Why

"While many of the NFT drops that have happened to date within the media space have focused on high-end single editions or multiple versions of collectibles, the release of TIMEPieces marks the first time a major media brand has taken on a Web3 approach toward building community and using this technology as an innovative extension of our current Digital Subscription efforts,” said former TIME president Keith Grossman at the last year's launch.

Our 0.02ETH 🍃

Covered by Mojito, the web3 consumer engagement platform. Empowering brand leaders with powerful tools to drive consumer engagement, sales, and loyalty for all levels of web3 maturity.

Signup for news, trends and analysis on tap. Join 2,000+ brand leaders going deeper into web3

Now Pass by NFT Now, a glimpse at the future of tokenized media

Mojito spotlights NFT Now, the tokenized media brand, and its landmark launch of the Now Pass.

Image credit: NFT Now

The Why

Tokenized media brand NFT Now believes the future of media is community-centric business models. The recent launch of their Now Pass and Now Network is the company's most significant web3-native move to date.

NFT Now: “We believe that media companies shouldn’t serve you ads. They should serve you opportunities.”

“The Now Pass is that first step for us in pioneering this community-centric media model, and starting to really redefine what the role is for a media brand in a Web3 environment,” said NFT Now Cofounder Matt Medved.

'Now Pass' utility

The 'Now Pass' grants holders access to:

- A Discord channel and “Alpha Chat” to share news and insights between members.

- Attend events, such as the NFT100 gala and an inaugural community meet-up held in New York during NFT.NYC.

- A membership portal where holders can earn rewards for their participation in the ecosystem.

- There are plans for an onchain voting system for content curation.

Results

NFT Now offered their Now Pass for $500 each, and sold out of their 2,750 total supply in less than 48 hours, raising $1.1 million. That price tag is the same as The Information's annual subscription, 50% more than the New York Times, and 10x more than the Wall Street Journal.

Extracts are sourced from NFT Now:

- ‘The Now Pass Sold Out. Here’s What’s Next’

- ‘The Now Pass Mint Is Officially Live’

- ‘Web2 Media Is Broken. The Future of Media Is Tokenized’

- @NFTNow tweets

Tokenized media brands we're tracking

137pm’s culture token promises access and collabs with cultural icons. Dirt aims to break down Web2 media regimes by publishing content from a network of freelancers, using blockchain infrastructure to keep media decentralized.

Our 0.02ETH 🍃

NFT Now has been deliberately building community since day one, and has strong support from builders and creators throughout the space (including us!). So it probably came as no surprise to the web3 community that NFT Now were able to sell 2,750 tokens, even at an elevated price point compared to traditional media. But how does this scale? How do the economic considerations of supply and demand come into play when it comes to making access to media brands liquid? Is the business model predicated on one-off sales of tokens, or will it mature to something more steady and reliable like subscriptions today? What forms of incentivized participation do communities actually want, and which will drive real ROI? Will royalties be a significant revenue stream, and if so, what's the right growth strategy there? If NFTs really could behave like cookies one day, and power a new-era of digital advertising, what specific steps should tokenized media brands being taking today to be poised for that future later? It's clear to us we are in the earliest innings here with many emergent possibilities ahead. What is clear is that media brands are motivated to experiment, and as we all know, necessity is the mother invention.

Covered by Mojito, the web3 consumer engagement platform. Empowering brand leaders with powerful tools to drive consumer engagement, sales, and loyalty for all levels of web3 maturity.

Signup for news, trends and analysis on tap. Join 2,200+ brand leaders going deeper into web3

Dorsey-backed Bluesky aims to give users algorithmic choice

Mojito spotlights Bluesky, Jack Dorsey's social media competitor, aiming to give users algorithmic choice

Image credit: Bluesky

What is Bluesky ?

Bluesky wants to enable a marketplace for media algorithms that users can vet and choose from in order to have total control over their feed, instead of it being decided for them by a centralized corporation.

The Why

Bluesky’s CEO Jay Graber has said that the idea is to “build a platform where a centralized figure cannot censor.”

Similar brands we're tracking

A number of Twitter alternatives have spun up recently, including Mastodon, Farcaster, and a rumored one coming from Facebook. They all talk about consumer control over what they see, and for publishers to be free from censorship, through the use of blockchain.

Our 0.02 ETH 🍃

While media brands like NFT Now and TIME are experimenting with ownable access passes and digital rewards as enhancements to their model, social media platforms like the above are betting that decentralized control over content recommendations will increase consumer satisfaction, trust, and ultimately, stickiness. How these worlds intersect at both the user experience level and the data interoperability level will be fascinating to watch play out, because clearly media brands and social media platforms will still need each other even in this new web3 world.

Covered by Mojito, the web3 consumer engagement platform. Empowering brand leaders with powerful tools to drive consumer engagement, sales, and loyalty for all levels of web3 maturity.

Signup for news, trends and analysis on tap. Join 2,000+ brand leaders going deeper into web3

Hot take | Web3 DTC

In DTC it’s about ‘who owns the customer;’ in web3, the customer owns the brand as much as the brand owns the customer

Direct-to-consumer brands eschew selling through intermediaries (e.g. department stores) in order to ‘own’ their customer relationships wherever they can. This means owning their contact information for future marketing, as well as their first-party data such as preferences or shopping habits for personalized offers or experiences. Brands have shown that direct-to-consumer business improves retention, lifetime value, and profitability, so it’s no surprise this has been a dominant trend among B2C companies for the past 20 years.

In DTC it’s all about ‘who owns the customer;’ in web3, the customer owns the brand as much as the brand owns the customer, and we believe this symbiotic evolution is transformatively positive for both parties.

This co-ownership model is achieved through brand NFTs, fungible currencies (eg. $FWB), or both, but it essentially means ‘tokenizing’ brand IP and allowing consumers to acquire, use and sell brand tokens at any time – frictionlessly, instantly and globally. Consumers get to own the unique asset itself, with all its possible benefits, but also own a share in the brand’s overall equity. This direct incentive alignment drives consumers to take it upon themselves to grow the brand as co-beneficiaries in its success. This is any marketer’s dream: an army of brand evangelists with a built-in affiliate model. Meanwhile, consumers passionate about their favorite brands get rewarded more directly for their evangelism. Win-win!

Consumers are already buying digital products. Last year consumers spent $2 billion on Roblox and $5 billion on Fortnite alone… and billions of hours on these platforms interacting with brands. But these assets are landlocked and can only be used within their native platforms. Web3 enables different digital products. Instead of being landlocked and ruggable, NFTs are interoperable and fully owned.

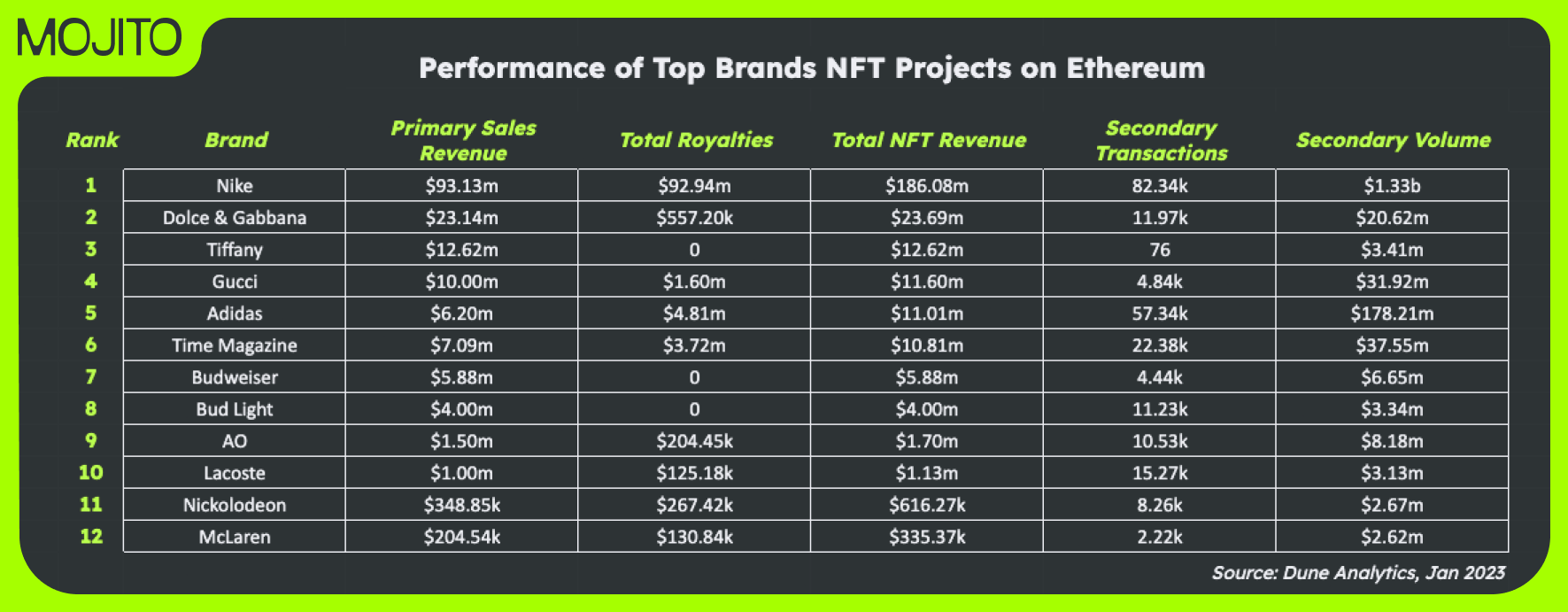

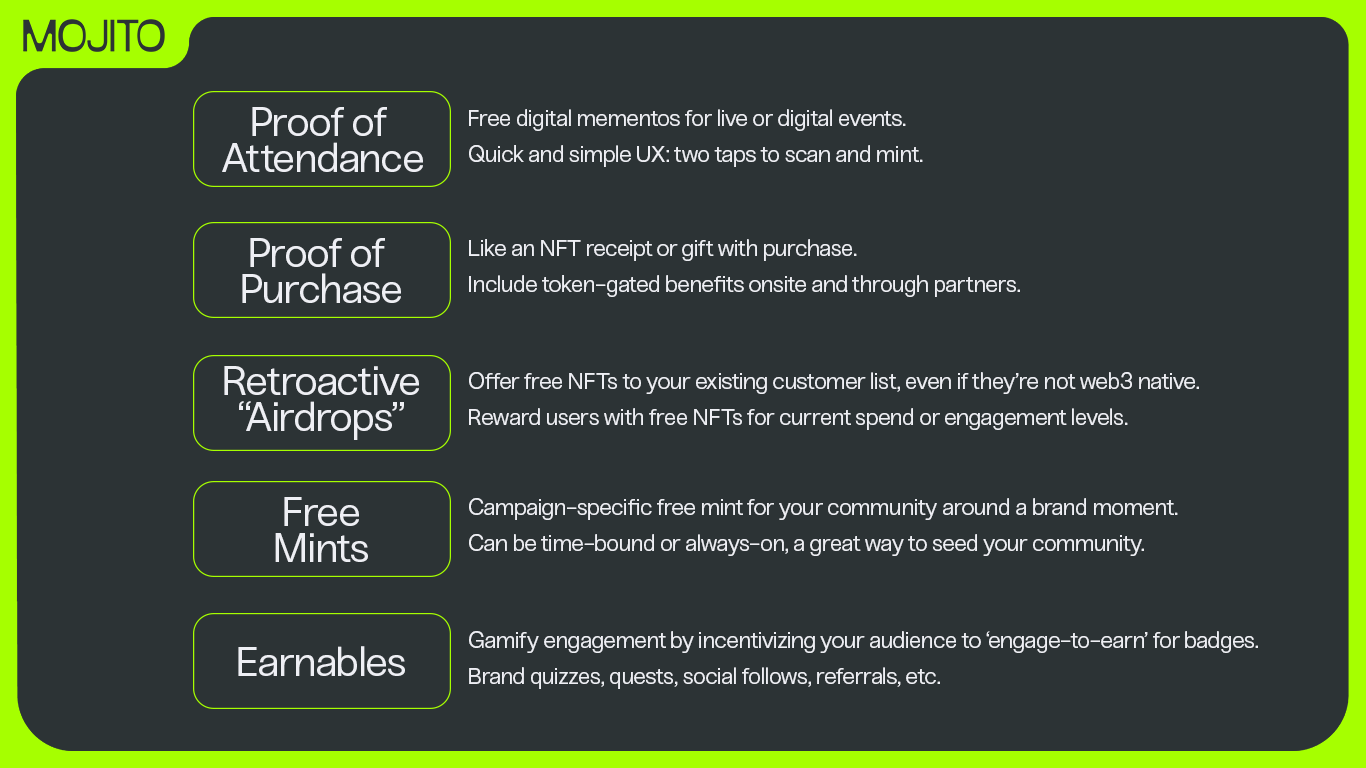

Brands are creating their own web3 platforms, not just products. Consumer giants like Nike understand the potential of a digital product line, generating over $186mm so far from NFTs. Late last year, they announced the launch of .SWOOSH, a community-based platform for digital shoes and jerseys that also unlock access to events, physical products, and co-creation opportunities. They are selling these digital products direct-to-consumer with creative ways to upsell and cross sell.

Secondary markets offer new ongoing revenue streams. Consumer brands today rarely capture any value when their items are resold. Unlike physical products, NFTs can be encoded with a ‘royalty’ such that every time it trades hands on the secondary market, a fraction of the payment is sent to the brand automatically. Web3 native brand Bored Ape Yacht Club has generated tens of millions in primary sale revenue, and more than $100mm in secondary royalties. That’s a new business model, and major traditional brands have noticed. Adidas and TIME have generated $5mm and $4mm, respectively, and Nike has earned more than $90mm in secondary royalties alone. The leading brands are adding custom secondary markets to their sites to retain traffic, stickiness and margins through a complete buying experience for consumers.

NFTs are powering supercharged loyalty programs. NFTs don’t have to be pricey to be effective. Starbucks is moving their 50-million-person loyalty program, which generated $15 billion in revenue last year, over to web3 platform 'Starbucks Odyssey'. They see NFTs improving that program by making loyalty ‘stamps’ ownable, and gamifying engagement in exchange for tradeable benefits like discounts and offers. As all marketers know, it’s always more cost effective to retain an existing customer than to acquire a new one. The incentivized nature of web3 adds a new dimension to loyalty and evangelism that big brands are starting to leverage.

NFT communities are dynamic peer-to-peer brand engagement groups. NFTs not only offer a new kind of DTC relationship for brands, but also for consumer to consumer. Token-based brand communities represent ‘fellow owners’ who are actively and organically interacting with each other about the brand in places like Discord and Telegram. This is also a low-effort way for brands to sustain a lively and engaged community: peer-to-peer brand discussions rather than more unidirectional engagements on Instagram and Twitter posts.

There are rich new consumer data insights in web3. Direct-to-consumer brands obsess about ‘first-party data’, essentially proprietary insights they glean about customers through their browsing and buying habits within their own ecosystem. Otherwise, brands have virtually no idea what customers are doing outside their four walls. This means rich customer data is splintered into silos across each brand’s incomplete picture, with no brand able to deliver an optimal experience for lack of full visibility.

Web3 data is much more interesting and powerful because it’s ‘open’ and tied to a consumer’s wallet address on-chain. Take a look at what other digital products they own, from which brands, and how they’re spending their money across all of crypto. All of this information is available and actionable on the blockchain.

The vision for DTC was always for brands to create and sustain lasting relationships directly with their consumer. Instead of a consumption-based relationship with the consumer, in web3 brands and consumers “win” together in a more participatory model. In the traditional sense of DTC, the financial relationship comes down to a “buy now” moment. With web3 and NFTs, it is a ‘buy into now,’ with a value exchange loop that doesn’t end; brand and consumer are intertwined by shared incentives to create value for each other. Consumers benefit from utility and perks, or from resell potential from a liquid ‘always-on’ market. The brand or creator benefits from transaction volume via embedded royalties… in the words of Charlie Munger, “show me the incentive and I’ll show you the outcome."

It’s certainly not a straightforward to simple step for a global brand to integrate blockchain technology into its existing framework. Those that have succeeded in making the web3 leap like Starbucks, Nike, adidas and Sotheby’s have all done so in different ways – sometimes it’s through membership, sometimes it's through loyalty and rewards, sometimes it's simply through a new digital product line. Brands that will be the winners of this DTC revolution are the ones who see its potential to not only supplement their existing business, but offer entirely new kinds of value to their consumers.

Hot take | 5 Free Ways to Grow Your Brand Audience with Web3

Web3 is moving past its experimental phase into its early adopter phase, and innovative brands are already staking out t

What's the trend?

Why are global brand giants like Nike and Starbucks getting into web3?

Sure, it might be because younger consumers show an appetite to buy digital products, but the true answer is more fundamental. Global brands are building in web3 for one major reason: data.

Interacting with consumers in web3 introduces a whole new kind of CRM with a richness of data not available to brands in web2. Marketers can see a connected wallet’s complete web3 activity, including interactions with other brands, interactions with other consumers, spending levels, and more.

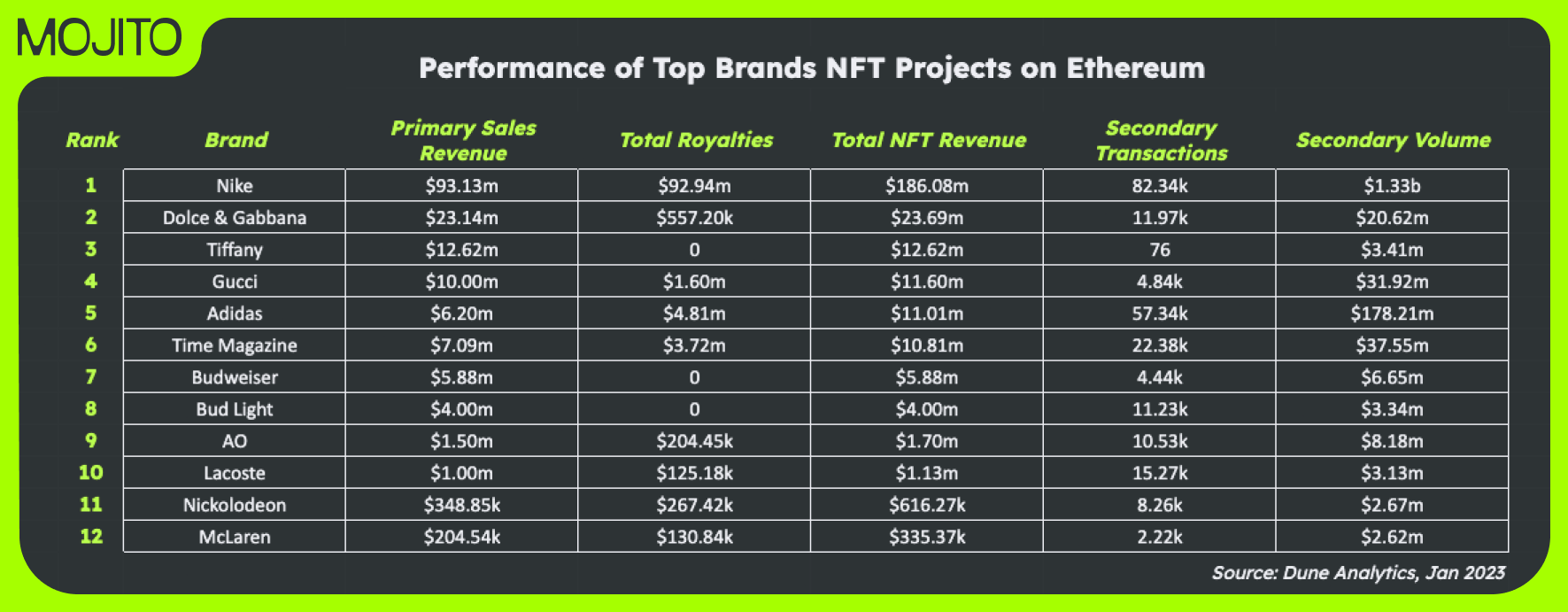

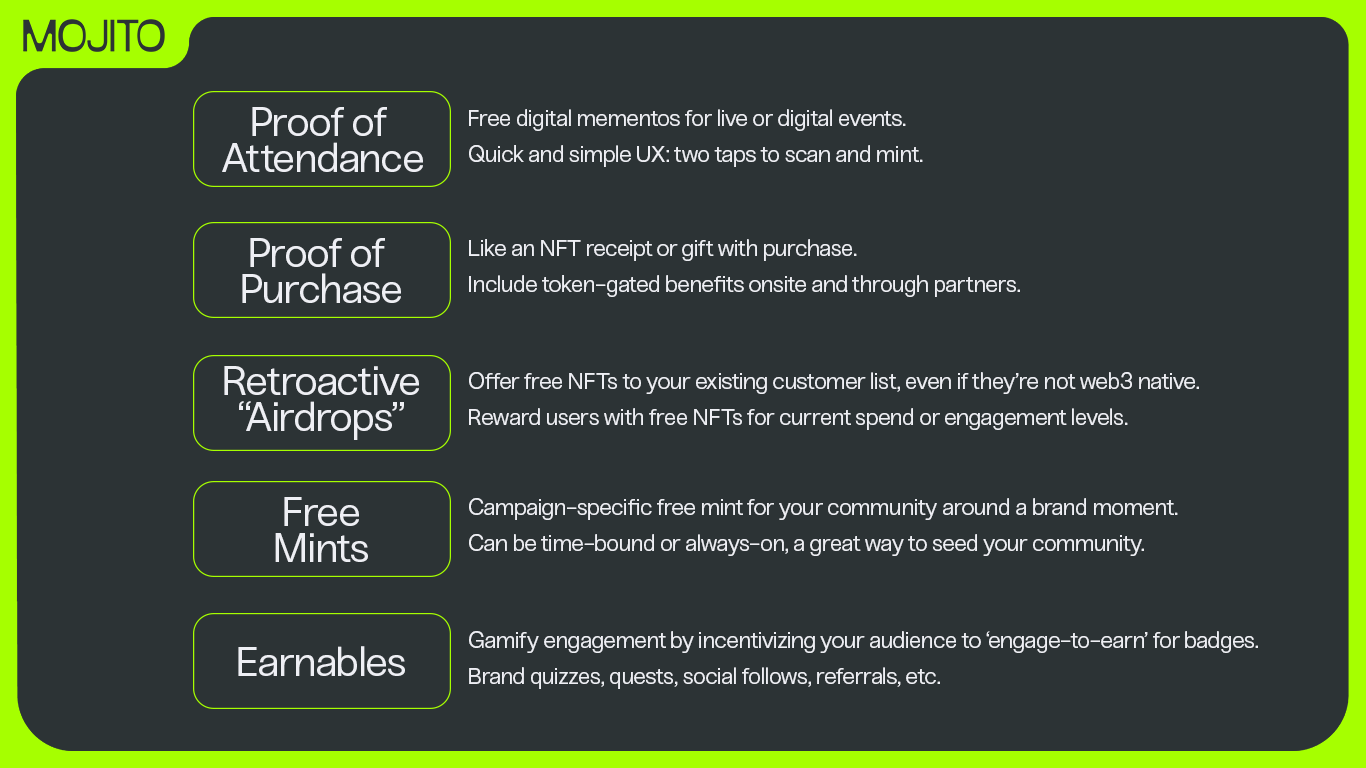

As a result, the latest trend among global brands in web3 is not to sell NFTs, but to give them away for free – with a focus on building a large tokenized community rather than immediate revenue. When you sell NFTs, naturally you’ll convert fewer than if they are free. The more NFTs you distribute, the more wallets you connect. The most wallets, the bigger your addressable audience and the more you know about them.

Building your web3 audience with free NFTs is a low-cost, low-risk way to develop an engaged and incentivized community. You do not need to deliver as much value on Day One as you would with a high-price NFTs, but instead build up the value proposition over time as you learn more about your consumer.

The most common way to do this is with a free ‘membership’ token distributed to existing users, allowlisted communities, or even the general public. Nike is minting free .SWOOSH ID (~300k so far in beta) for users to co-create and engage in its emerging web3 ecosystem, while Starbucks minted free ‘earnable’ Stamps to users who complete brand engagement ‘journeys’. In both cases, these global brands are onboarding their existing users to web3 and/or attracting web3 native users into their ecosystems, and enriching their consumer datasets at the same time.

This is the next evolution of consumer web3. No more quick and dirty cashgrabs. Instead, brands will focus on building their web3 dataset, seeding their web3 community, and growing consumer value over time in order to increase lifetime value and evangelism.

Build your web3 audience with free NFTs

Here are proven ways you can capitalize on this growing trend:

So what questions can you ask the data?

🤔 What percentage of existing customers converted to our free NFT? How many of those wallets have any prior web3 activity? How many are brand new to crypto? What’s different about these customers compared to those who did not convert?

🤔 Of the new users to your brand, what’s their prior web3 activity? How do these users differ from your existing customers who converted?

🤔 Of those with prior web3 activity, what third-party collections and platforms have they interacted with, how often, how recently, and how much was spent? What are the other most popular NFTs your community owns?

What happens next? Ok, your free NFT strategy worked, and you now have a large and active web3 community clamoring for more. This is when it gets exciting:

🎁 Token-gated experiences: Brands can offer value to web3 audiences by gating content, merchandise, events, and more behind ‘token-gates’. These are webpages or mobile apps that require a user to prove ownership of a specific NFT in order to access or interact. This is an immediate way to make a free NFT valuable to the owner.

🎁 Token-based personalization: More than just an access token, where all NFTs within a collection carry effectively the same value, brands can also detect that someone owns a certain trait, number, or set of tokens, and then deliver a personalized experience around that.

🎁 Token-based collaborations: Web3 interoperability makes brand collaborations and community cross-pollinating extremely easy and effective. Brands can offer token-gated value not only to their own NFT audience, but others as well. This is an effective way to reward holders, create buzz and grow community.

How can Mojito help?

Web3 is moving past its experimental phase into its early adopter phase, and innovative brands are already staking out their territory and setting the bar high. This means the time to start building your own web3 community was yesterday.

Mojito has powered free NFT drops for the Milwaukee Bucks, Liverpool FC, Sotheby’s, CAA, Lyrical Lemonade and more. Get caught up quick and build a foundation for future campaigns with low-risk, low-cost free NFT activations powered by Mojito.

Signup for news, trends and analysis on tap. Join 2,000+ brand leaders going deeper into web3

Trend | Engage-to-earn or ‘gamification’ is the dominant emerging trend in consumer web3 right now.

Brands are increasingly launching or planning their own direct-to-consumer NFT marketplaces.

Image credit:

What's the trend?

These are not new ideas to marketers, and it’s a simple premise:

- Identify commercial (spend money, refer a customer) and non-commercial (‘engagement’) consumer interactions to increase

- Offer extrinsic (discounts, prizes) and intrinsic (status, leaderboard) rewards to the consumer for performing these actions

- Tune for profitable growth

Historically, brands have done this through programs like shopping rewards, frequent flier miles, credit card cashback, VIP concierge, and blue checks. There was a web2.0 gamification era that saw mixed results on balance looking back. Broadly speaking, you might even say it has fallen somewhat out of favor with consumers and brands alike.

Too many different dashboards, too many unredeemed rewards, too little value for the consumer for too much work, and for brands, too much disparate data to feasibly stitch across a multi-platform, multi-touchpoint consumer journey.

Flash forward to today and web3 seems poised to address all of these issues, and further supercharge the gamification dream with onchain capabilities that offchain reward systems just can’t match, like interoperability, tradeability, and real-time universal aggregation.

- Interoperability – Web3 allows consumers to visualize and manage all their digital rewards in one wallet, a single dashboard. Interoperability is also what allows consumers the option to use their digital rewards from one brand in another brand’s ecosystem. In other words, they’re portable from the consumer’s perspective.

- Tradeability – Web3 means always-on liquidity for digital rewards, so no more unredeemed value. Instead, if consumers don’t want to use a discount or gift, they can simply sell it to someone else who does. This kind of economy helps gamification programs thrive because the value of the digital rewards are inherently and tangibly higher.

- Real-Time Universal Aggregation – Remember, ‘web3’ just means ‘blockchain,’ and blockchain just means ‘decentralized database’. Several pioneering brands are solving the multi-platform data integration problem with the blockchain itself, using dynamic NFTs like first-party cookies to aggregate a user’s real-time engagement data. This can power personalization on any front-end once a user connects wallet. Watch this space, it’s wild

Our 0.02ETH 🍃

Traditional channels engage traditional audiences. Brands that are serious about reaching new audiences are putting web3 at the heart of their marketing strategies. Offering free (or rather "earned") tokens for consumers who interact with your brand is supercharging gamified engagement. Don't miss out on what Nike, adidas and Starbucks are already harnessing... web3 consumer engagement!

Covered by Mojito, the web3 consumer engagement platform. Empowering brand leaders with powerful tools to drive consumer engagement, sales, and loyalty for all levels of web3 maturity.

Signup for news, trends and analysis on tap. Join 2,000+ brand leaders going deeper into web3

Art Blocks champions creator royalties in its own marketplace launch

Art Blocks expanded beyond generative art drops and now has its own direct-to-consumer NFT marketplace

Image credit: Art Blocks

What launched

Art Blocks expanded beyond generative art drops and now has its own direct-to-consumer marketplace, to

“...address 3 pain points: security, authenticity, and royalties.”

Like most creators and brands, Art Blocks pride itself on offering a premium experience to showcase their artwork.

Value prop

Generative artists launching on Art Blocks get to build out their collections in a media-rich environment meanwhile Art Blocks keeps a captive audience of generative art buyers on their site for further discovery, in turn enriching Art Blocks’ engagement data .

Key features

- Art Blocks gives its generative art community a more brand-aligned home for secondary trading with enforceable royalties.

- The experience goes beyond an eBay-like shopping experience through editorial content that spotlights the projects and individual pieces, similar to Sotheby’s.

- Art Blocks can offer their community a secure place to buy and sell that’s free of fakes and knock-offs.

- Art Blocks hinted at adding post-mint, and collector rewards, in further support for artist discovery.

Our 0.02ETH 🍃

By brands owning the experience and royalty rails instead of handing them over to generalist marketplaces (Opensea, Blur) the brand will own the infrastructure and data to build rewards for the discovery and buying behaviours the brand wants to incentivise. At Mojito, we’re heads down bringing more secondary marketplaces to market right now, we’re excited to share news and learnings soon.

Covered by Mojito, the web3 consumer engagement platform. Empowering brand leaders with powerful tools to drive consumer engagement, sales, and loyalty for all levels of web3 maturity.

Signup for news, trends and analysis on tap. Join 2,000+ brand leaders going deeper into web3

Trend | Direct-to-Consumer NFT marketplaces on the rise

Brands are increasingly launching or planning their own direct-to-consumer NFT marketplaces.

Image credit: XCOPY Right-click and Save As guy

What's the trend?

Brands have always seen value in direct-to-consumer mint pages because it’s the best way to own the storytelling and conversion funnel for that critical touchpoint in the user journey.

But after that, most brands until recently would just hand off the ensuing traffic, engagement and sales to third-party marketplaces like OpenSea.

Now brands are increasingly launching or planning their own direct-to-consumer NFT marketplaces.

Our 0.02ETH 🍃

Now brands are increasingly launching or planning their own direct-to-consumer NFT marketplaces. This is for 3 key reasons:

- Royalty Enforcement: When OpenSea paid royalties to brands and creators on every secondary transaction, it was ROI-positive to outsource marketplace functionality. Now most major third-party marketplaces have stopped enforcing royalties, instead generating their own user engagement and revenue off the back of your brand IP. By contrast, of course, you can enforce royalties on your own marketplace!

- Owning The User Experience: Marketplace trading is one of the most valuable interactions token holders can make with your brand. Direct-to-consumer brands want to own the full user journey because it’s the best way to convert new customers as well as engage and monetize repeat customers. Since the 2021 NFT drop era is long over, and now the trend is to deliver high-value benefits and experiences for token holders, the arc is clearly bending toward brands needing to own their full web3 user journey just like web2.

- Cost & Speed to Market: Marketplaces require a lot more functionality than just a simple mint page, so it was typically too resource-intensive for a brand to launch their own marketplace. Now options like Mojito exist for brands to launch their own direct-to-consumer marketplace in 3 weeks or less with our standard UX templates and APIs – all for a reasonable monthly SaaS fee.

Covered by Mojito, the web3 consumer engagement platform. Empowering brand leaders with powerful tools to drive consumer engagement, sales, and loyalty for all levels of web3 maturity.

Signup for news, trends and analysis on tap. Join 2,000+ brand leaders going deeper into web3